Best credit cards for rewards bring a world of opportunities for savvy consumers looking to make the most of their spending habits. From cash back to travel rewards, explore the diverse landscape of credit card perks and benefits in this comprehensive guide.

As we delve deeper into the realm of credit card rewards, you’ll discover the best options available and uncover valuable tips for maximizing your benefits.

Types of Rewards Credit Cards

When it comes to rewards credit cards, there are several types available in the market, each offering different benefits and perks to cardholders. Let’s compare and contrast some of the most common types:

Cash Back Rewards Cards

Cash back rewards cards offer cardholders a percentage of their spending back in cash. This type of rewards card is popular for its simplicity and flexibility, allowing cardholders to use their cash back rewards however they choose.

Travel Rewards Cards

Travel rewards cards are designed for frequent travelers, offering points or miles that can be redeemed for flights, hotel stays, and other travel-related expenses. These cards often come with additional travel perks such as airport lounge access and travel insurance.

Points Rewards Cards

Points rewards cards offer cardholders points for every dollar spent, which can be redeemed for a variety of rewards such as merchandise, gift cards, or even cash back. These cards are versatile and allow cardholders to choose how they want to use their points.

Other Types of Rewards Cards

In addition to cash back, travel rewards, and points cards, there are other types of rewards cards that offer specific benefits such as gas rewards, grocery rewards, or hotel rewards. These cards are tailored to specific spending habits and preferences.

Popular Credit Cards for Rewards

When it comes to credit cards that offer fantastic rewards, there are several popular options that stand out in the market. These credit cards provide cardholders with a variety of perks, bonuses, and rewards that can help them save money and earn valuable benefits.

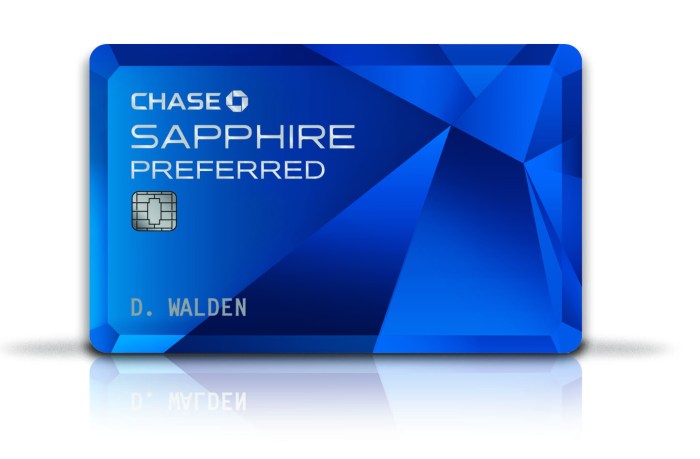

Chase Sapphire Preferred

The Chase Sapphire Preferred card is highly regarded for its generous rewards program. Cardholders can earn valuable points on every purchase, with bonus points for dining and travel expenses. These points can be redeemed for travel, gift cards, or cash back. Additionally, cardholders can enjoy perks such as travel insurance and no foreign transaction fees. To maximize the benefits of this card, cardholders should aim to use it for dining and travel expenses to earn bonus points faster.

When it comes to planning for retirement, it’s essential to have the best retirement investment strategies in place. These strategies can help you secure your financial future and ensure that you have enough savings to enjoy your golden years. By investing wisely and diversifying your portfolio, you can maximize your returns and minimize risks. Check out this resource on Best retirement investment strategies to learn more about how to make the most of your retirement savings.

American Express Gold Card

The American Express Gold Card is another popular choice for those seeking great rewards. Cardholders can earn points on dining, supermarkets, and flights booked directly with airlines. These points can be redeemed for travel, gift cards, or merchandise. The card also offers statement credits for dining and airline fees, as well as travel insurance benefits. To make the most of this card, cardholders should focus on using it for dining and supermarket purchases to earn the most points.

Citi Double Cash Card

The Citi Double Cash Card is known for its simple yet rewarding cash back program. Cardholders can earn cash back on all purchases, with a bonus for paying off their balance. This card has no annual fee and offers a straightforward way to earn cash back on everyday expenses. To maximize the benefits of this card, cardholders should aim to pay off their balance in full each month to earn the full cash back amount.

Factors to Consider When Choosing a Rewards Credit Card: Best Credit Cards For Rewards

.png?w=700)

When selecting a rewards credit card, there are several key factors that individuals should consider to ensure they are maximizing the benefits and rewards offered. From annual fees to rewards structure, each aspect plays a crucial role in determining the suitability of a credit card for an individual’s financial needs.

Annual Fees, Best credit cards for rewards

One of the primary factors to consider when choosing a rewards credit card is the annual fee associated with the card. While some cards may offer lucrative rewards, they often come with higher annual fees. It is important to weigh the benefits of the rewards against the cost of the annual fee to determine if the card is worth it in the long run.

Interest Rates

Another important factor to consider is the interest rates charged on the credit card. High-interest rates can quickly negate the value of any rewards earned, especially if the cardholder carries a balance from month to month. It is essential to choose a card with competitive interest rates to avoid paying excessive interest charges.

When it comes to planning for retirement, it’s essential to consider the best retirement investment strategies. These strategies can help you secure your financial future and ensure a comfortable retirement. By investing in a diverse portfolio that includes stocks, bonds, and real estate, you can maximize your returns and minimize risk. To learn more about the best retirement investment strategies, check out this comprehensive guide: Best retirement investment strategies.

Rewards Structure and Redemption Options

The rewards structure of a credit card should align with the individual’s spending habits and lifestyle. Whether it’s cash back, travel rewards, or points-based rewards, the card should offer rewards that are valuable and relevant to the cardholder. Additionally, the redemption options should be flexible and easy to use to maximize the benefits of the rewards earned.

Sign-Up Bonuses and Introductory Offers

When choosing a rewards credit card, it is crucial to consider the sign-up bonuses and introductory offers available. These initial perks can provide a significant boost to the rewards earned in the first few months of card ownership. Cardholders should evaluate the value of the sign-up bonuses and introductory offers to determine if they align with their financial goals and spending patterns.

Tips for Maximizing Credit Card Rewards

When it comes to maximizing credit card rewards, there are several strategies you can implement to make the most out of your spending. By following these tips, you can optimize your rewards without falling into debt and take full advantage of the perks offered by your credit card.

Strategies for Maximizing Credit Card Rewards

- Choose the Right Card: Select a credit card that aligns with your spending habits to maximize rewards. Whether you prefer cash back, travel rewards, or points, make sure the card benefits cater to your needs.

- Utilize Bonus Categories: Take advantage of rotating bonus categories offered by your credit card issuer to earn extra rewards on specific purchases. Make sure to activate these categories to maximize your rewards.

- Track Your Spending: Keep a close eye on your spending to ensure you are staying within budget while maximizing rewards. Avoid overspending just to earn rewards, as it may lead to debt in the long run.

- Redeem Rewards Timely: Don’t let your rewards go to waste by forgetting to redeem them. Make sure to cash in your rewards regularly to enjoy the benefits they offer.

Managing Spending to Optimize Rewards

- Set a Budget: Establish a budget to control your spending and avoid accumulating unnecessary debt. Stick to your budget while maximizing rewards to ensure financial stability.

- Avoid Carrying Balances: Pay off your credit card balance in full each month to avoid accruing interest charges. By staying debt-free, you can fully enjoy the rewards you earn.

- Monitor Your Rewards Balance: Keep track of your rewards balance to know how much you have accumulated. This will help you plan your redemptions and take advantage of special promotions.

Redeeming Rewards and Special Promotions

- Take Advantage of Sign-Up Bonuses: Sign up for credit cards with lucrative sign-up bonuses to earn extra rewards right from the start. Make sure to meet the spending requirements to qualify for these bonuses.

- Be Aware of Promotional Offers: Stay informed about special promotions and offers provided by your credit card issuer. These promotions can help you earn extra rewards or receive discounts on purchases.

- Redeem Rewards Wisely: When redeeming your rewards, opt for options that provide the most value, such as travel redemptions, gift cards, or statement credits. Compare redemption options to maximize the benefits of your rewards.

End of Discussion

In conclusion, navigating the world of credit card rewards can be a rewarding experience when armed with the right knowledge and strategies. By choosing the best credit cards for rewards and leveraging their perks wisely, you can unlock a world of possibilities for your financial journey.

Clarifying Questions

What factors should I consider when choosing a rewards credit card?

When selecting a rewards credit card, it’s crucial to evaluate factors like annual fees, interest rates, rewards structure, and redemption options to align with your spending habits and lifestyle.

How can I maximize credit card rewards effectively?

To maximize credit card rewards, consider strategies like managing spending to optimize rewards without accruing debt, tracking rewards diligently, redeeming them on time, and taking advantage of special promotions.