Business loan rates for SMEs takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this discussion, we will delve into the intricate details surrounding business loan rates for small and medium enterprises, exploring how these rates play a crucial role in the financial landscape of SMEs.

Overview of Business Loan Rates for SMEs

Business loan rates for SMEs refer to the interest rates charged by financial institutions when lending money to small and medium-sized enterprises. Understanding these rates is crucial for SMEs as they directly impact the cost of borrowing and, ultimately, the financial health of the business.Loan rates can significantly influence an SME’s financial health in various ways. High-interest rates can increase the cost of borrowing, leading to higher monthly payments and potentially straining the company’s cash flow.

On the other hand, low-interest rates can make borrowing more affordable, allowing SMEs to invest in growth opportunities and expand their operations. It is essential for SME owners to carefully consider loan rates and choose financing options that align with their business goals and financial capabilities.

Factors Influencing Business Loan Rates

To understand the dynamics behind business loan rates for SMEs, it is crucial to examine the various factors that influence these rates. Several key elements come into play when determining the interest rates offered to small and medium-sized enterprises seeking financial assistance.

Credit Score

One of the primary factors that significantly impact business loan rates is the credit score of the borrower. Lenders use credit scores to assess the creditworthiness of SMEs and determine the risk associated with lending money. A higher credit score typically results in lower interest rates, as it indicates a lower risk of default.

Business Revenue

The revenue generated by the business is another critical factor that influences loan rates for SMEs. Lenders consider the financial stability and growth potential of the business when setting interest rates. Higher business revenues often lead to lower loan rates, as they demonstrate the ability to repay the borrowed amount.

Loan Term

The duration of the loan term also plays a significant role in determining business loan rates. Shorter loan terms usually come with lower interest rates, as they pose less risk to lenders. On the other hand, longer loan terms may result in higher interest rates to compensate for the extended repayment period and potential fluctuations in the market.

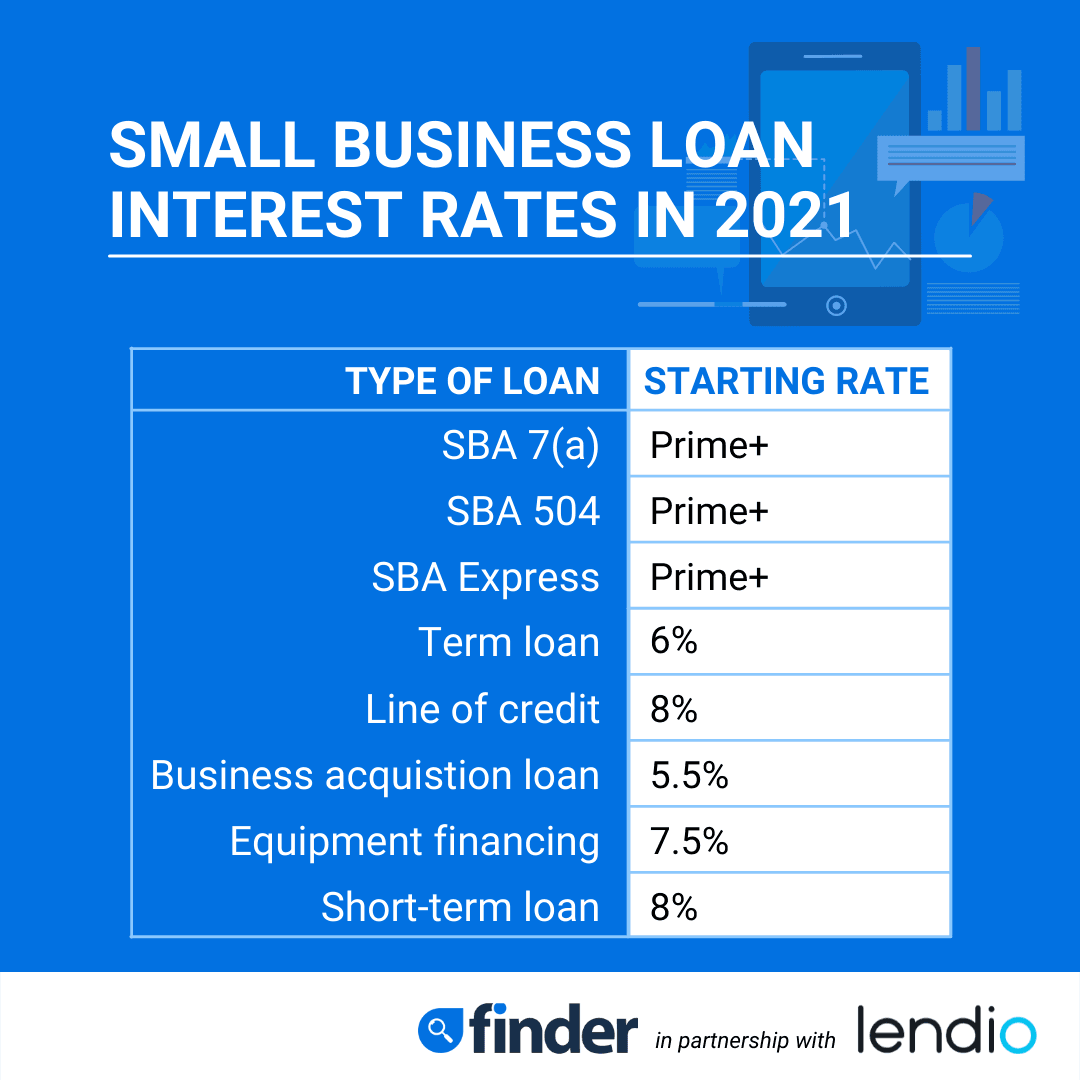

Types of Business Loans Available for SMEs

When it comes to obtaining financing for small and medium enterprises (SMEs), there are several types of business loans available. Each type of loan comes with its own set of terms and conditions, which can impact the interest rates charged to the borrower.

Term Loans

Term loans are a popular choice for SMEs looking to finance specific projects or investments. These loans are typically repaid over a fixed period of time, with set monthly payments. The interest rates for term loans can vary depending on the lender’s assessment of the borrower’s creditworthiness and the length of the loan term.

Line of Credit, Business loan rates for SMEs

A line of credit is a flexible form of financing that allows SMEs to borrow funds up to a certain limit. Interest is only charged on the amount borrowed, making it a cost-effective option for managing cash flow fluctuations. The interest rates for a line of credit may be lower compared to term loans, as they are typically tied to the prime rate.

Equipment Financing

Equipment financing is specifically designed to help SMEs purchase new equipment or machinery. The interest rates for equipment financing can be more competitive, as the equipment itself serves as collateral for the loan. Lenders are more willing to offer lower rates due to the reduced risk associated with this type of loan.

When it comes to the business loan application process, proper preparation is key to success. Before applying, it’s essential to gather all necessary documents, such as financial statements and business plans. Understanding the requirements of different lenders can also help streamline the process. Additionally, maintaining a good credit score and having a clear understanding of the terms and conditions can improve the chances of approval.

To learn more about the business loan application process, visit Business loan application process.

Invoice Financing

Invoice financing allows SMEs to access funds by using their outstanding invoices as collateral. This type of financing can help improve cash flow by providing immediate access to working capital. Interest rates for invoice financing are usually higher compared to traditional loans, as lenders take on a higher level of risk by advancing funds based on unpaid invoices.

SBA Loans

SBA loans are backed by the Small Business Administration and are designed to provide affordable financing options for SMEs. These loans typically offer competitive interest rates and longer repayment terms than traditional loans. The SBA’s guarantee reduces the risk for lenders, allowing them to offer favorable terms to small businesses.

When applying for a business loan, the process can sometimes be overwhelming. From gathering the necessary documents to filling out the application, it’s crucial to be prepared. Understanding the business loan application process is key to increasing your chances of approval. Make sure to have your financial statements, business plan, and credit history ready. Additionally, be prepared to explain how you will use the funds and how you plan to repay the loan.

By following these steps, you can navigate the application process smoothly and efficiently.

How to Secure the Best Business Loan Rates for SMEs

When it comes to securing the best business loan rates for SMEs, there are several strategies that can be employed to increase the chances of getting favorable terms. From improving credit scores to negotiating with lenders, here are some tips to help SMEs access competitive loan rates.

Improving Credit Scores

- Pay bills on time: Ensuring that all outstanding bills and debts are paid on time can significantly improve credit scores.

- Reduce debt: Lowering the amount of outstanding debt can positively impact credit scores and increase the likelihood of securing better loan rates.

- Monitor credit reports: Regularly checking credit reports for inaccuracies and addressing any errors promptly can help improve credit scores.

Negotiating with Lenders

- Shop around: Comparing loan offers from different lenders can provide leverage when negotiating for competitive rates.

- Highlight strong financials: Demonstrating a strong financial position and a solid business plan can make SMEs more attractive to lenders, potentially leading to better loan terms.

- Be prepared to negotiate: Being prepared to negotiate terms with lenders, including interest rates and repayment schedules, can help secure more favorable loan rates.

Last Recap

In conclusion, understanding business loan rates for SMEs is paramount for the success and growth of small and medium enterprises. By navigating the complexities of loan rates and implementing strategic approaches, SMEs can secure favorable rates that propel their financial well-being.

FAQ Explained

What are business loan rates for SMEs?

Business loan rates for SMEs refer to the interest rates charged on loans specifically tailored for small and medium enterprises to support their financial needs.

How do different factors influence business loan rates for SMEs?

Various factors such as credit score, business revenue, and loan term can significantly impact the interest rates SMEs receive on their loans.

What types of business loans are available for SMEs?

There are various types of business loans for SMEs, including term loans, lines of credit, and SBA loans, each with different terms and interest rates.

How can SMEs secure the best business loan rates?

SMEs can secure favorable loan rates by improving their credit scores, exploring different loan types, and negotiating with lenders for competitive rates.