Credit card balance transfer offers provide a valuable opportunity to effectively manage debt and save money. Let’s delve into the benefits, strategies, and key considerations surrounding these offers.

Credit Card Balance Transfer Offers

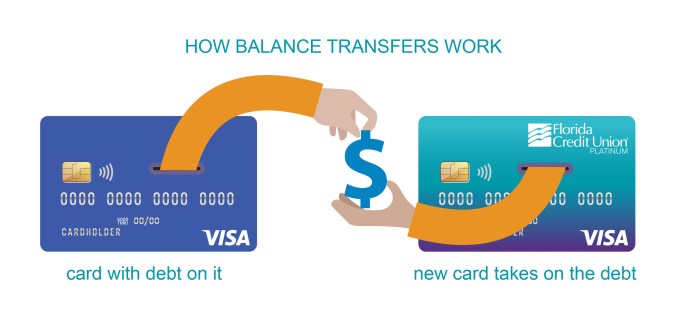

When credit card users transfer their existing balance from one credit card to another, they can take advantage of credit card balance transfer offers. These offers typically come with a promotional period during which a lower or 0% interest rate is applied to the transferred balance.

Benefits of Utilizing Credit Card Balance Transfer Offers

- Lower Interest Rates: By transferring balances to a card with a lower or 0% interest rate, users can save money on interest payments.

- Consolidation of Debt: Combining multiple balances into one account can make it easier to manage and keep track of debt payments.

- Opportunity to Pay Off Debt Faster: With lower interest rates, more of the payment goes towards the principal balance, allowing users to pay off debt quicker.

Managing Debt Effectively with Credit Card Balance Transfer Offers

- Creating a Repayment Plan: Taking advantage of the promotional period to create a structured plan for paying off the balance before the regular interest rate kicks in.

- Avoiding Accumulation of Interest: By making timely payments and paying off the balance within the promotional period, users can avoid accumulating additional interest charges.

- Improving Credit Score: Successfully managing debt through balance transfers can reflect positively on credit scores, as long as payments are made on time and debt is reduced.

How to Utilize Credit Card Balance Transfer Offers

When it comes to utilizing credit card balance transfer offers, there are specific steps to follow and factors to consider to maximize the benefits. Here we will Artikel a step-by-step guide on how to transfer a credit card balance, detail the key factors to consider when choosing a credit card for balance transfer offers, and compare different credit card balance transfer offers available in the market.

When looking for the best investment opportunities in 2025, it’s crucial to consider various factors such as market trends, economic forecasts, and emerging industries. One promising sector to explore is renewable energy, with advancements in technology driving growth and sustainability. Another area to watch is the healthcare industry, which continues to expand globally. Additionally, investing in tech companies with innovative solutions can yield significant returns.

For more insights on potential investments, check out Best investment opportunities 2025.

Step-by-Step Guide on How to Transfer a Credit Card Balance

- Check your current credit card balance and interest rate to determine if a balance transfer is beneficial.

- Research and compare different credit card balance transfer offers to find the best one for your financial situation.

- Apply for the new credit card with the balance transfer offer and wait for approval.

- Once approved, initiate the balance transfer process by providing the necessary information from your existing credit card.

- Monitor the transfer process and ensure that the balance is successfully transferred to the new credit card.

- Start making payments on the new credit card to take advantage of the lower or 0% introductory APR offer.

Factors to Consider When Choosing a Credit Card for Balance Transfer Offers

- Introductory APR: Look for credit cards with a low or 0% introductory APR to save on interest charges.

- Balance Transfer Fee: Consider the balance transfer fee charged by the credit card issuer, as it can impact the overall cost of transferring the balance.

- Introductory Period: Take note of the length of the introductory period for the low or 0% APR offer to plan your payments accordingly.

- Credit Limit: Ensure that the new credit card has a sufficient credit limit to accommodate the balance transfer amount.

- Rewards and Benefits: Evaluate any additional rewards or benefits offered by the credit card to maximize your savings or earn rewards while paying off the balance.

Comparison of Different Credit Card Balance Transfer Offers

| Credit Card | Introductory APR | Balance Transfer Fee | Introductory Period |

|---|---|---|---|

| Credit Card A | 0% | 3% | 12 months |

| Credit Card B | 1.99% | 2.5% | 15 months |

| Credit Card C | 2.99% | 2% | 18 months |

Understanding the Fine Print

When considering credit card balance transfer offers, it is crucial to pay attention to the fine print. Understanding the key terms and conditions can help you make an informed decision and avoid any unexpected fees or charges.

When looking for the best investment opportunities in 2025, it’s important to consider various factors such as emerging industries, technological advancements, and global economic trends. One promising area to explore is renewable energy, with the push for sustainability growing stronger each year. Investing in innovative startups within the healthcare sector is also a smart move, as the demand for healthcare services continues to rise.

Additionally, keeping an eye on the real estate market, especially in developing countries, can lead to profitable returns. To learn more about the best investment opportunities in 2025, check out this insightful article Best investment opportunities 2025.

Key Terms and Conditions to Look Out For

- Introductory APR: This is the interest rate that will be applied to your balance transfer for a certain period. Make sure to note how long the introductory period lasts and what the APR will be once it ends.

- Balance Transfer Fee: Some credit card companies charge a fee for transferring a balance. This fee is typically a percentage of the amount transferred.

- Minimum Payment Requirements: Be aware of the minimum monthly payment required on the transferred balance to avoid penalties.

- Potential Penalties: Understand the consequences of missing payments or not adhering to the terms of the balance transfer offer.

Hidden Fees and Charges

- Annual Fees: Some credit cards may have an annual fee that could offset any savings from a balance transfer.

- Foreign Transaction Fees: If you plan to use the credit card for purchases abroad, be mindful of any additional fees that may apply.

- Late Payment Fees: Missing a payment deadline can result in hefty penalties and may affect the promotional APR.

Impact of Interest Rates and Potential Savings

- Calculate Potential Savings: Consider how much you could save by transferring a balance to a card with a lower interest rate. Use a balance transfer calculator to estimate your savings based on the new APR.

- Interest Rates: The interest rate on the balance transfer can significantly impact your overall savings. Be sure to compare rates and terms before making a decision.

Tips for Maximizing Credit Card Balance Transfer Offers

When utilizing credit card balance transfer offers, it is important to have a strategic plan in place to make the most of the promotional period. Here are some tips to help you maximize the benefits of balance transfers:

Paying off Transferred Balances Before Promotional Periods End

- Set a realistic repayment plan: Calculate how much you need to pay each month to clear the balance before the promotional period ends. Make sure you stick to this plan to avoid high interest rates kicking in.

- Avoid new purchases on the card: Focus on paying off the transferred balance instead of adding more debt to the card. This will help you clear the balance faster and avoid accumulating more interest.

- Consider automated payments: Set up automatic payments for the minimum amount due each month to avoid missing a payment and incurring penalties. You can always make additional payments to accelerate the payoff process.

Avoiding Common Pitfalls When Using Credit Card Balance Transfer Offers

- Avoid missing payments: Missing a payment can lead to the promotional period ending early and higher interest rates being applied. Stay organized and make payments on time to fully benefit from the offer.

- Be mindful of balance transfer fees: Factor in any balance transfer fees when calculating the overall cost of transferring the balance. Ensure that the savings from the lower interest rate outweigh the fees incurred.

- Avoid closing old accounts: Closing old credit card accounts after transferring the balance can negatively impact your credit score. Keep the accounts open but avoid using them to maintain a healthy credit utilization ratio.

Maintaining a Good Credit Score While Utilizing Balance Transfers

- Monitor your credit utilization ratio: Try to keep your credit utilization below 30% to demonstrate responsible credit management. Utilizing balance transfers can help lower your overall utilization and improve your credit score.

- Regularly check your credit report: Monitor your credit report for any errors or discrepancies that could impact your credit score. Address any issues promptly to maintain a good credit standing.

- Avoid opening multiple new accounts: While balance transfers can be beneficial, opening multiple new credit accounts can negatively impact your credit score. Limit new credit applications to maintain a stable credit profile.

Conclusion

In conclusion, Credit card balance transfer offers can be a powerful tool in your financial management arsenal, helping you tackle debt and improve your credit score. Make the most of these offers by understanding the fine print and implementing smart repayment strategies.

FAQ Explained

What are credit card balance transfer offers?

Credit card balance transfer offers allow you to move existing credit card debt to a new card with lower interest rates.

How can I maximize credit card balance transfer offers?

To make the most of these offers, focus on paying off transferred balances before promotional periods end and avoid common pitfalls like missing payments.

What factors should I consider when choosing a credit card for balance transfer offers?

Consider the length of the promotional period, transfer fees, ongoing interest rates, and your ability to repay the balance within the promotional period.