High return savings accounts offer a lucrative opportunity for maximizing your savings. From understanding what they are to strategies for optimizing returns, this guide explores everything you need to know.

When it comes to making the most of your savings, high return savings accounts can play a crucial role in helping you achieve your financial goals.

Understanding High Return Savings Accounts

High return savings accounts are financial products offered by banks or credit unions that provide higher interest rates compared to traditional savings accounts. These accounts are designed to help individuals grow their savings faster and maximize their returns on deposited funds.

Benefits of Having a High Return Savings Account, High return savings accounts

There are several benefits to having a high return savings account:

- Higher Interest Rates: High return savings accounts offer higher interest rates, allowing account holders to earn more on their savings over time.

- Compound Interest: The compounding effect of higher interest rates can significantly increase the overall growth of savings in the account.

- Financial Security: By earning more interest on their savings, individuals can build a stronger financial cushion for emergencies or future financial goals.

- Easy Access to Funds: Most high return savings accounts allow for easy access to funds through online banking or ATMs, making it convenient for account holders to withdraw money when needed.

Comparison with Traditional Savings Accounts

When comparing high return savings accounts with traditional savings accounts, the key differences lie in the interest rates and overall returns:

- Interest Rates: High return savings accounts offer significantly higher interest rates compared to traditional accounts, leading to greater earnings on deposited funds.

- Minimum Balance Requirements: Some high return savings accounts may require a higher minimum balance to qualify for the top interest rates, while traditional savings accounts may have lower or no minimum balance requirements.

- Accessibility: Traditional savings accounts may offer easier access to funds through branches or ATMs, whereas high return savings accounts may have limitations on withdrawals to maintain the higher interest rates.

- Overall Returns: Due to the higher interest rates and potential for greater earnings through compounding, high return savings accounts generally provide a better return on investment compared to traditional accounts.

Factors to Consider When Choosing a High Return Savings Account: High Return Savings Accounts

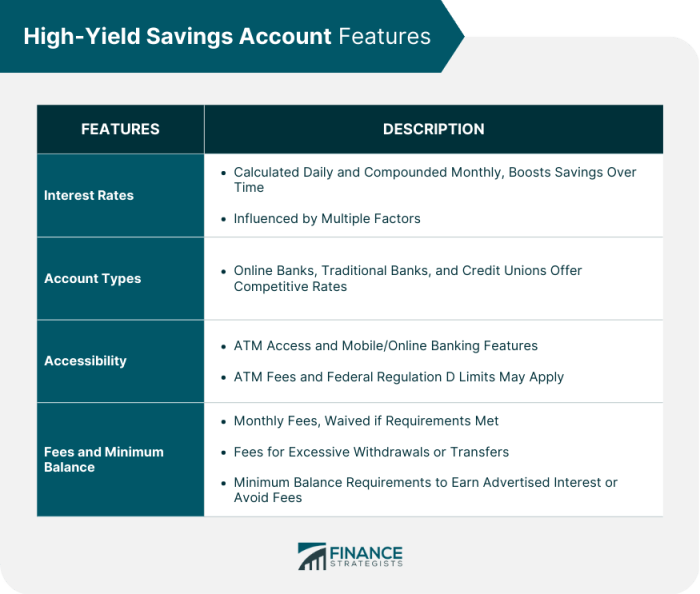

When choosing a high return savings account, there are several factors to keep in mind to make an informed decision. These factors include interest rates offered, minimum balance requirements, and associated fees.

Interest Rates Offered by Different Banks

When comparing high return savings accounts, one of the key factors to consider is the interest rates offered by different banks. Higher interest rates can help your savings grow faster over time, so it’s important to look for accounts that offer competitive rates. Some banks may also offer promotional rates or tiered interest rates based on your account balance.

Minimum Balance Requirements

Another important factor to consider is the minimum balance requirements for high return savings accounts. Some accounts may require a minimum balance to open the account, while others may have ongoing minimum balance requirements to avoid fees or qualify for the high interest rate. Make sure to choose an account that aligns with your saving goals and financial situation.

Fees Associated with High Return Savings Accounts

It’s crucial to be aware of any fees associated with high return savings accounts. Common fees include monthly maintenance fees, excessive withdrawal fees, and fees for falling below the minimum balance. Be sure to read the account terms and conditions carefully to understand the fee structure and how it may impact your savings.

Are you new to investing and interested in learning about mutual funds? Understanding mutual funds for beginners is a great way to start building your investment portfolio. Mutual funds offer a diversified investment option that can help spread out risk while potentially earning higher returns. By learning the basics of mutual funds, you can make informed decisions about where to invest your money for long-term financial growth.

Strategies for Maximizing Returns

When it comes to high return savings accounts, there are several strategies you can implement to ensure you are maximizing your returns and making the most out of your savings. By understanding how compound interest works and regularly contributing to your account, you can significantly boost your savings over time.

Leverage Compound Interest

One of the key strategies for maximizing returns with high return savings accounts is to leverage compound interest. Compound interest allows you to earn interest not only on your initial deposit but also on the interest that has already been earned. This means that your savings can grow exponentially over time, especially if you leave your money in the account for an extended period.

When it comes to investing, mutual funds are often recommended for beginners due to their diversification and professional management. If you’re new to the world of investing, mutual funds for beginners can provide a great starting point. With a wide range of options available, you can choose a fund that aligns with your risk tolerance and investment goals.

Additionally, mutual funds offer the benefit of being managed by experts who make decisions on behalf of investors, making it a hassle-free way to grow your money.

Regular Contributions

Another important strategy is to make regular contributions to your high return savings account. By consistently adding to your savings, you are increasing the principal amount on which interest is calculated. This, in turn, leads to higher returns over time. Setting up automatic transfers from your checking account to your savings account can help ensure you are contributing regularly without having to think about it.

Risks and Limitations of High Return Savings Accounts

When considering high return savings accounts, it is essential to be aware of the potential risks and limitations that come with them. These factors can impact the overall return on investment and affect your financial goals.

Potential Risks Associated with High Return Savings Accounts

- Interest Rate Risk: High return savings accounts are subject to fluctuations in interest rates. If rates decrease, the returns on your account may also decrease, impacting your earnings.

- Liquidity Risk: Some high return savings accounts may have restrictions on withdrawals or require a minimum balance to be maintained. This could limit access to your funds when needed.

- Inflation Risk: Inflation can erode the purchasing power of your savings over time. Even though high return savings accounts offer competitive interest rates, if the rate of inflation exceeds your earnings, the real value of your money could decrease.

Limitations and Restrictions of High Return Savings Accounts

- Minimum Balance Requirements: Many high return savings accounts have minimum balance requirements to earn the advertised interest rate. Falling below this balance may result in lower returns or fees.

- Withdrawal Limits: Some accounts may limit the number of withdrawals you can make per month without incurring fees. This can restrict access to your funds in case of emergencies.

- Fees and Charges: High return savings accounts may come with maintenance fees or charges for certain transactions. It is important to understand these costs to assess the actual return on your investment.

Impact of Inflation on Actual Returns

Inflation can have a significant impact on the actual returns generated by high return savings accounts. If the rate of inflation is higher than the interest earned on your account, the purchasing power of your savings will diminish over time. It is crucial to consider inflation when evaluating the overall returns and effectiveness of a high return savings account as a long-term investment strategy.

Final Thoughts

In conclusion, high return savings accounts provide a valuable avenue for growing your savings through competitive interest rates and strategic financial planning. By considering the factors discussed and implementing effective strategies, you can make the most of these accounts and secure a stronger financial future.

Top FAQs

What are high return savings accounts?

High return savings accounts are financial accounts that offer higher interest rates compared to traditional savings accounts, allowing individuals to earn more on their deposits.

What factors should I consider when choosing a high return savings account?

When selecting a high return savings account, it’s essential to review the interest rates, minimum balance requirements, and any associated fees to ensure it aligns with your financial goals.

How can I maximize returns with a high return savings account?

To optimize returns, consider leveraging compound interest, regularly contributing to the account, and exploring various strategies to make the most of the higher interest rates offered.

Are there any risks or limitations associated with high return savings accounts?

While high return savings accounts offer attractive interest rates, it’s important to be aware of potential risks, limitations, and how inflation can impact the actual return on investment.