Low monthly payment car loans are a popular option for those looking for affordable car financing. In this comprehensive guide, we’ll delve into the key aspects of these loans, from understanding them to managing them effectively.

Understanding Low Monthly Payment Car Loans

When it comes to low monthly payment car loans, it refers to auto financing options that offer lower monthly payments compared to traditional loans. These types of loans are designed to make purchasing a vehicle more affordable for individuals who may have budget constraints or prefer lower monthly expenses.

When it comes to purchasing a new car, finding the best car financing options is crucial. With so many choices available, it can be overwhelming to decide which one is the right fit for your budget and needs. By exploring different options such as Best car financing options , you can find a plan that offers competitive rates and flexible terms.

Whether you’re looking for a loan from a bank, credit union, or dealership, it’s important to compare offers and choose the one that works best for you.

Factors Influencing Monthly Payment Amount

- Loan Amount: The total amount borrowed for the car purchase will directly impact the monthly payment.

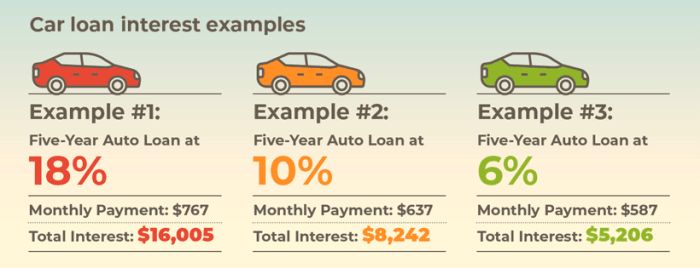

- Interest Rate: The interest rate applied to the loan will determine how much interest is accrued each month.

- Loan Term: The length of the loan term can affect the monthly payment amount, with longer terms typically resulting in lower payments.

- Down Payment: The size of the down payment made at the time of purchase can reduce the loan amount and lower the monthly payment.

Benefits of Opting for Low Monthly Payment Car Loans

- Improved Affordability: Low monthly payments make it easier for individuals to manage their cash flow and budget effectively.

- Increased Buying Power: With lower monthly payments, borrowers may qualify for a larger loan amount, allowing them to purchase a more expensive vehicle.

- Flexible Financial Planning: Low monthly payments provide flexibility for individuals to allocate funds to other expenses or savings goals.

Qualifying for Low Monthly Payment Car Loans

When it comes to qualifying for low monthly payment car loans, there are certain requirements that borrowers need to meet. Lenders usually have specific criteria in place to determine eligibility for these types of loans.

Typical Requirements for Qualifying

- Good credit score: Lenders often look for borrowers with a good credit history as it indicates their ability to repay the loan on time.

- Stable income: Having a steady source of income is important to show lenders that you can afford the monthly payments.

- Low debt-to-income ratio: Lenders may consider your debt-to-income ratio to ensure you have enough income to cover the loan payments.

Comparison of Eligibility Criteria

Different lenders may have varying eligibility criteria for low monthly payment car loans. While some lenders may prioritize credit score, others may focus more on income stability. It’s essential to compare the requirements of different lenders to find the best fit for your financial situation.

Tips to Improve Chances of Qualifying

- Work on improving your credit score by making timely payments and reducing outstanding debt.

- Show proof of stable income through pay stubs or employment verification.

- Consider making a larger down payment to reduce the loan amount and potentially lower the monthly payments.

Finding Lenders Offering Low Monthly Payment Car Loans

When searching for lenders that offer low monthly payment car loans, it is essential to consider both traditional financial institutions and online lenders. Popular options known for providing competitive rates and terms include banks, credit unions, and online lending platforms. Here is a breakdown of the process of finding and comparing loan offers from different lenders:

Researching and Comparing Loan Offers, Low monthly payment car loans

- Start by researching different lenders in your area or online that specialize in car loans.

- Check their interest rates, loan terms, and any additional fees associated with the loan.

- Use online tools and comparison websites to gather quotes from multiple lenders for easy comparison.

- Consider factors such as the total cost of the loan, monthly payments, and flexibility in repayment options.

Negotiating for Better Terms

- Once you have gathered offers from different lenders, don’t hesitate to negotiate for better terms.

- Highlight your creditworthiness, stable income, and any existing relationships with the lender to leverage a better deal.

- Ask about any available discounts, promotions, or incentives that could help reduce your monthly payment amount.

- Be prepared to walk away if the terms offered are not in line with your financial goals and needs.

Managing Low Monthly Payment Car Loans

When it comes to managing low monthly payment car loans, it is crucial to have a solid financial plan in place to avoid any potential financial strain. Timely payments and proper budgeting are key to ensuring that you can comfortably meet your loan obligations without putting yourself in a difficult financial situation.

When looking for the best car financing options, it’s important to consider various factors such as interest rates, loan terms, and fees. One of the top choices in the market is Best car financing options which offers competitive rates and flexible repayment plans. By comparing different lenders and understanding the terms and conditions, you can find the option that best suits your budget and needs.

Effective Budgeting and Planning

- Start by creating a detailed budget that Artikels all your monthly expenses, including your car loan payment.

- Identify areas where you can cut back on spending to free up additional funds for your car loan.

- Set aside a specific amount each month for your car loan payment to ensure that it is always accounted for in your budget.

- Consider setting up automatic payments to avoid missing any due dates and incurring late fees.

Consequences of Missing Payments

- Missing or delaying payments on your low monthly payment car loan can result in late fees and a negative impact on your credit score.

- Your lender may also repossess your vehicle if you consistently fail to make payments, putting you at risk of losing your transportation.

- Additionally, missed payments can lead to increased interest rates and overall higher costs over the life of the loan.

Final Conclusion

In conclusion, navigating the world of low monthly payment car loans is now more manageable with the insights provided in this guide. Stay informed, plan wisely, and enjoy the benefits of financial flexibility with these convenient loan options.

Common Queries: Low Monthly Payment Car Loans

What factors influence the monthly payment amount?

Factors such as loan term, interest rate, and loan amount can all impact the monthly payment amount.

How can I qualify for low monthly payment car loans?

To qualify, you typically need a good credit score, stable income, and possibly a down payment.

What are the consequences of missing payments on these loans?

Missing payments can lead to late fees, a negative impact on your credit score, and potential repossession of the vehicle.