Mutual fund investment strategy is a crucial aspect of financial planning, offering investors a roadmap to achieve their goals effectively. Dive into the world of mutual funds and explore the strategies that can lead to success.

From growth to income strategies, learn how different approaches can impact your investments and pave the way for a secure financial future.

Importance of Mutual Fund Investment Strategy

Having a well-thought-out investment strategy is crucial for mutual fund investors as it provides a roadmap for achieving their financial goals effectively. A clear strategy helps investors make informed decisions, manage risks, and stay focused on their objectives.

When looking to buy your first car, it’s essential to consider financing options. A first-time car buyer loan can be a great solution for those with limited credit history. These loans typically come with competitive interest rates and flexible terms, making it easier for new buyers to get behind the wheel of their dream car. By exploring different loan options, first-time car buyers can find the best deal that suits their budget and needs.

Benefits of a Clear Investment Strategy

- Asset Allocation: A defined strategy helps investors allocate their assets wisely across different asset classes to diversify risk and maximize returns.

- Long-Term Planning: By outlining specific goals and timelines, investors can plan for major life events such as retirement, education, or buying a home.

- Risk Management: A strategy helps investors assess their risk tolerance and choose funds that align with their financial goals and comfort level with risk.

Examples of Successful Investment Strategies

- Index Investing: Following a passive strategy by investing in low-cost index funds to match the performance of a particular market index.

- Value Investing: Identifying undervalued mutual funds with solid fundamentals and holding them for the long term to benefit from their growth potential.

- Market Timing: Using technical analysis and economic indicators to buy and sell mutual funds at the right time to capitalize on market trends.

Types of Mutual Fund Investment Strategies

Investors can choose from various types of mutual fund investment strategies based on their financial goals and risk tolerance. These strategies can broadly be categorized into growth, value, income, and index strategies. Each strategy has its unique approach to selecting investments and achieving returns.

Growth Strategy

A growth strategy focuses on investing in companies with high growth potential. These companies typically reinvest their earnings into expanding their business operations, leading to higher stock prices. Mutual funds following a growth strategy aim to provide capital appreciation by investing in stocks of companies expected to experience above-average growth.

Value Strategy

Contrary to growth strategy, value strategy involves investing in companies that are undervalued by the market. These companies may have strong fundamentals but are trading at a discount compared to their intrinsic value. Mutual funds following a value strategy seek to capitalize on the market’s underestimation of these companies and generate returns when the market corrects its pricing.

Income Strategy

Income strategy focuses on generating regular income for investors through dividends or interest payments. Mutual funds following an income strategy typically invest in dividend-paying stocks, bonds, or other income-generating securities. Investors who prioritize a steady income stream over capital appreciation may opt for mutual funds with an income strategy.

As a first-time car buyer, securing a loan can be a daunting task. However, with the right guidance and information, you can navigate through the process smoothly. One option to consider is a first-time car buyer loan designed specifically for individuals purchasing their first vehicle. This type of loan often comes with special benefits and terms tailored to new car buyers, making it a great choice for those entering the world of car ownership.

Index Strategy

Index strategy involves replicating the performance of a specific market index, such as the S&P 500. Mutual funds following an index strategy aim to match the returns of the chosen index by holding a similar portfolio of securities. These funds typically have lower expenses compared to actively managed funds, making them a cost-effective way to gain exposure to the broader market.

Active vs. Passive Strategies

Active investment strategies involve frequent buying and selling of securities to outperform the market. Fund managers actively make investment decisions based on their research and market outlook. In contrast, passive investment strategies aim to replicate the performance of a specific index without trying to outperform it. Passive funds have lower expenses and are more suitable for investors looking for broad market exposure without active management.Examples of mutual funds following these strategies include:

Growth Strategy

Vanguard Growth Index Fund (VIGAX)

Value Strategy

Dodge & Cox Stock Fund (DODGX)

Income Strategy

Vanguard High Dividend Yield Index Fund (VHYAX)

Index Strategy

SPDR S&P 500 ETF Trust (SPY)Each of these funds implements its respective investment strategy to achieve specific investment objectives for shareholders.

Factors Influencing Mutual Fund Investment Strategies

Investing in mutual funds involves a careful consideration of various factors that can influence the selection of an investment strategy. These factors play a crucial role in determining the optimal approach to achieve the desired investment goals while managing risks effectively.

Market Conditions

Market conditions have a significant impact on the selection of mutual fund investment strategies. During periods of economic growth and stability, investors may opt for more aggressive strategies to capitalize on market opportunities. Conversely, in times of uncertainty or market downturns, a more conservative approach focused on capital preservation may be preferred.

- Market volatility can influence the choice between active and passive investment strategies.

- Interest rates, inflation, and geopolitical events can also impact the selection of asset classes within a mutual fund portfolio.

Risk Tolerance

Risk tolerance is another key factor that influences the selection of mutual fund investment strategies. Investors with a higher risk tolerance may choose growth-oriented strategies with a focus on equities, while conservative investors may opt for fixed-income or balanced strategies to mitigate potential losses.

- Understanding risk tolerance helps investors align their investment strategies with their comfort level and financial objectives.

- Asset allocation plays a crucial role in managing risk and diversifying the portfolio based on an investor’s risk tolerance.

Investment Goals and Time Horizon

Investment goals and time horizon are essential considerations when determining the most suitable mutual fund investment strategy. Short-term goals may require a different approach than long-term goals, influencing the choice of asset classes, investment vehicles, and risk management strategies.

- Investors with long-term goals may focus on growth-oriented strategies to capitalize on compounding returns over time.

- Matching the investment strategy with the time horizon helps optimize the portfolio for achieving specific financial objectives.

Diversification, Asset Allocation, and Fund Selection

Diversification, asset allocation, and fund selection are critical components that shape the overall investment strategy for mutual funds. Diversifying across different asset classes, sectors, and geographic regions can help mitigate risks and enhance portfolio returns.

- Asset allocation involves strategically allocating investments across various asset classes based on risk-return objectives and market conditions.

- Choosing the right mutual funds based on performance, fees, and investment objectives is essential for building a well-rounded investment portfolio.

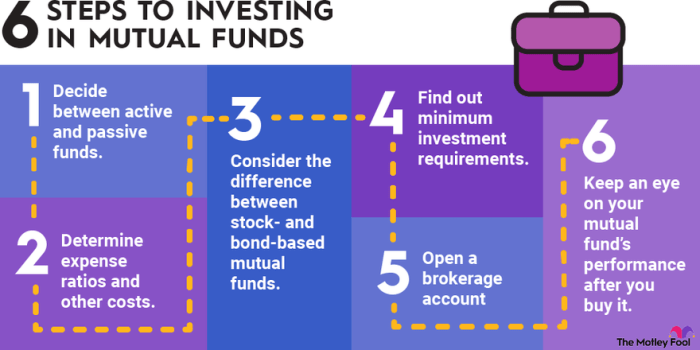

Implementing a Successful Mutual Fund Investment Strategy

Implementing a successful mutual fund investment strategy requires careful planning and monitoring to ensure optimal returns. Here is a step-by-step process to design and implement an effective strategy:

Step 1: Set Clear Financial Goals

- Define your investment objectives, whether it’s retirement planning, wealth creation, or saving for a specific goal.

- Identify your risk tolerance and time horizon to determine the appropriate investment approach.

Step 2: Choose the Right Mutual Funds

- Research and select mutual funds that align with your financial goals, risk profile, and investment horizon.

- Diversify your portfolio by investing in a mix of equity, debt, and hybrid funds to spread risk.

Step 3: Monitor and Adjust the Strategy

- Regularly review your portfolio’s performance and make adjustments based on changing market conditions.

- Monitor the fund manager’s performance and ensure they are sticking to the investment strategy.

Step 4: Regular Reviews and Rebalancing, Mutual fund investment strategy

- Conduct periodic portfolio reviews to ensure it remains aligned with your financial goals and risk tolerance.

- Rebalance your portfolio by selling overperforming funds and investing in underperforming ones to maintain the desired asset allocation.

Closure

In conclusion, mastering the art of mutual fund investment strategy can open doors to financial success. By understanding the key factors and implementing a well-thought-out plan, investors can navigate the complex world of mutual funds with confidence and precision.

Popular Questions: Mutual Fund Investment Strategy

How important is having a well-thought-out investment strategy for mutual fund investors?

Having a clear strategy is crucial as it helps investors effectively achieve their financial goals and navigate the volatile market conditions.

What are the key factors that influence the selection of an investment strategy for mutual funds?

Factors such as market conditions, risk tolerance, investment goals, and time horizon play a significant role in determining the most suitable strategy.

How can investors monitor and adjust their mutual fund investment strategy over time?

Regular reviews, rebalancing, and staying informed about market trends are essential for adapting the strategy to changing conditions.